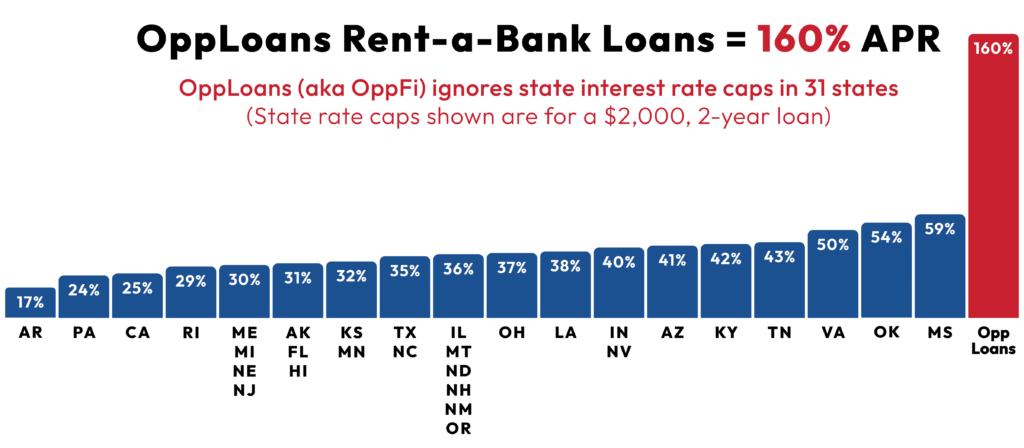

Interest rate limits are the simplest and most effective protection against predatory lending. Since the time of the American Revolution, states have limited interest rates to protect their residents. American voters strongly support interest rate caps. At least 45 states and the District of Columbia (DC) cap rates on at least some installment loans.

But high-cost lenders are increasingly using rent-a-bank schemes with a small number of rogue banks, which are not subject to state interest rate limits, to evade state rate caps on installment loans and lines of credit. Several high-cost consumer lenders – American First Finance, CNG Holdings, EasyPay, Elevate, Enova, LoanMart, OppLoans, Personify Financial, and Total Loan Services (through EZ$Money Check Cashing, LoanMe, Lendly LLC, MoneyKey, Quickcredit.com, and SunUp Financial) – are laundering loans through five FDIC-supervised banks: Capital Community Bank, FinWise Bank, First Electronic Bank, and TAB Bank of Utah, and Republic Bank & Trust of Kentucky.

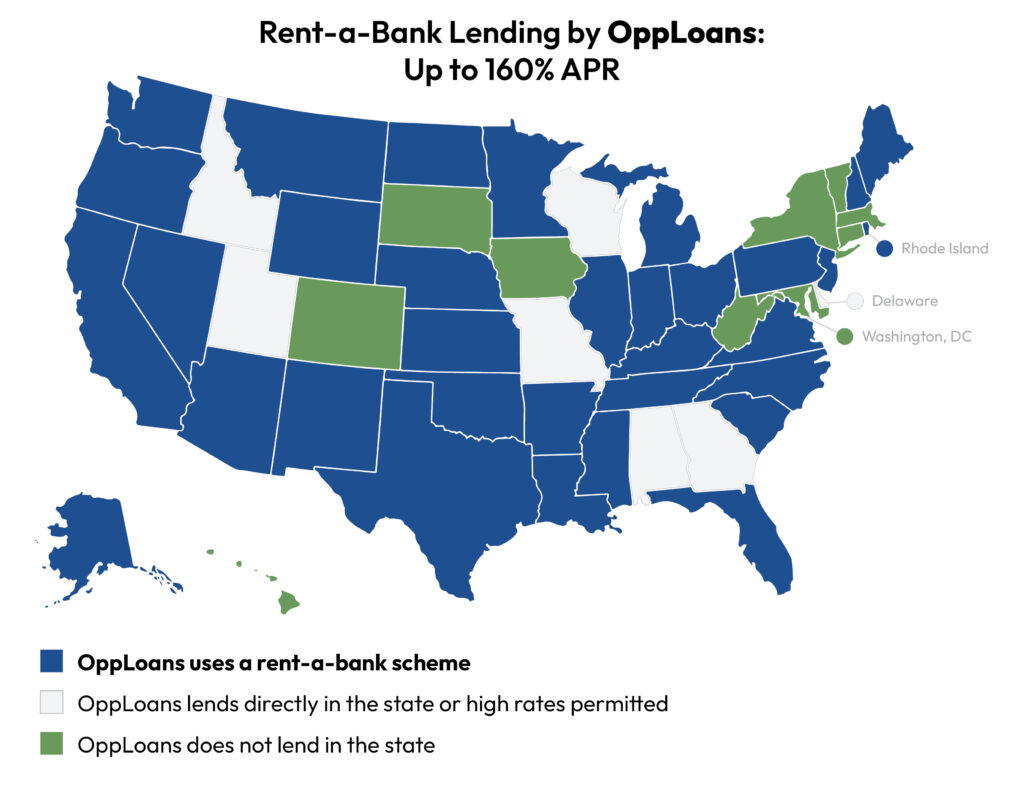

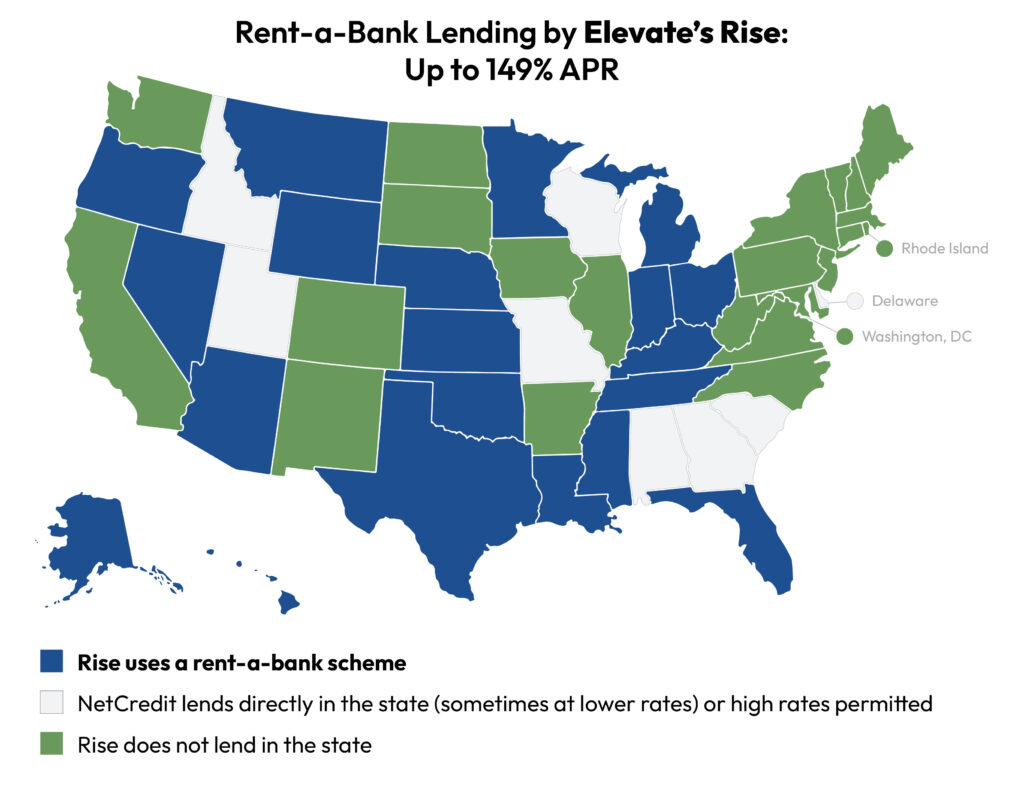

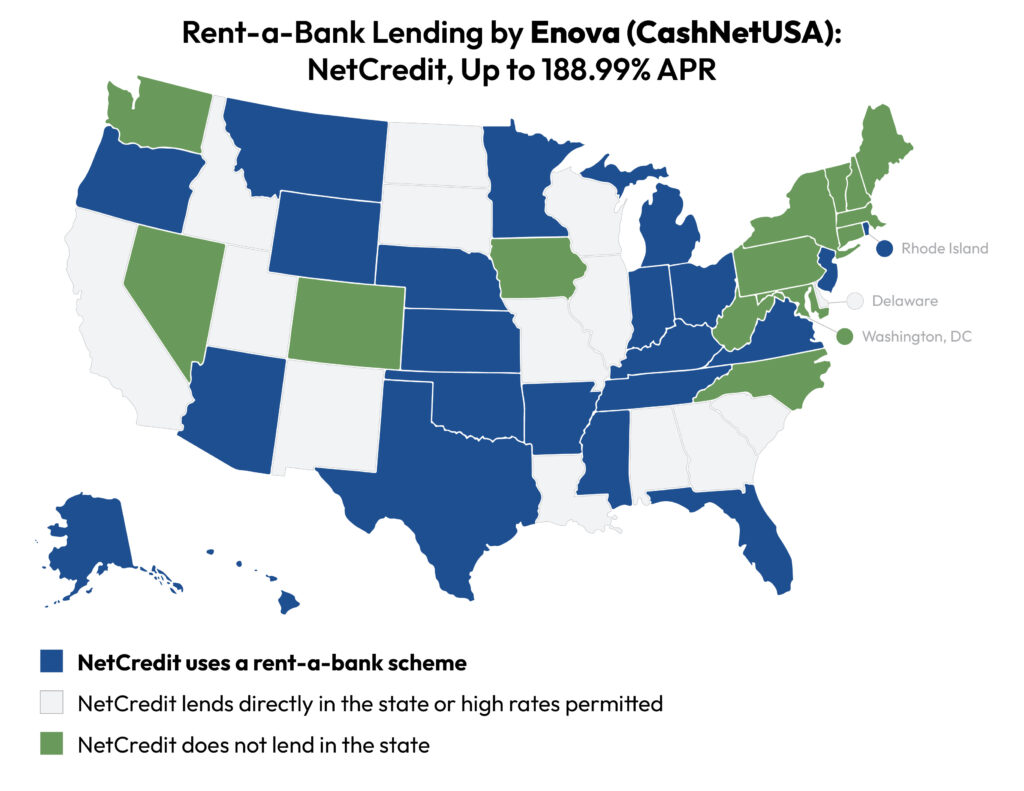

Rent-a-bank schemes are of questionable legality. Lenders pick and choose where they lend, generally avoiding states that vigorously enforce their laws.

See below to learn about the banks and lenders teaming up to issue triple-digit interest, debt-trap loans in states that do not allow high-cost loans — and which states they avoid.

FIND YOUR STATE in this spreadsheet to see how many “rent-a-bank” lenders are attempting to avoid rate caps in your state.

Watch out for These High-Cost Lenders and Their Bank Partners

OppLoans (aka OppFi) uses FDIC-supervised FinWise Bank (Utah), Capital Community Bank (CC Bank) (Utah), and First Electronic Bank, a Utah industrial bank, to make installment loans of $500 to $4,000 at 160% APR in a number of states that do not allow that rate for some or all loans in that size range. OppLoans has been sued by the State of California and by the District of Columbia Attorney General for engaging in a rent-a-bank scheme and agreed to pay $2 million and stop evading DC’s usury laws.

- Sample OppLoans/FinWise Bank loan: A $3,000 loan at 160% APR for 12 Months. 12 Payments of $514.60 each for a total of $6,175.20.

Duvera Billing Services dba EasyPay Finance offers high-cost credit through businesses across the country that sell auto repairs, furniture, home appliances, pets, wheels, and tires, among other items – including predatory puppy loans. EasyPay’s website does not disclose its rates, but examples from consumers in some states include $1,500 loans at 188.99% APR. EasyPay extends credit through FDIC-supervised Transportation Alliance Bank dba TAB Bank (Utah) in several states, that may not allow that rate. EasyPay’s website states that it administers financing directly in other states, most likely under state lending or retail installment sales laws.

EasyPay Finance has settled enforcement actions brought by Colorado and the District of Columbia for making unlawful loans, and Transportation Alliance Bank was forced by Iowa to stop facilitating EasyPay loans.

Note: The map at the top of this page on How Many Rent-a-Bank Lenders Operate in Your State does not include states where EasyPay operates directly.

Elevate’s Rise uses FDIC-supervised FinWiseBank(Utah) and Capital Community Bank (Utah) to make installment loans of $500 to $5,000 with APRs of 99% to 149% in several states that do not allow those rates for some or all loans in that size range. Rise also lends directly in a number of other states. In addition to the Rise installment loan, Elevate also offers a line of credit, Elastic, using FDIC-supervised Republic Bank & Trust (Kentucky), at an effective APR of about 100% in a number of states that do not allow that rate. Elevate was sued by the DC Attorney General for engaging in a rent-a-bank scheme and agreed to a nearly $4 million settlement and to stop usurious lending in DC.

Enova, which operates the payday and installment lender CashNetUSA, uses the NetCredit brand through FDIC-supervised Republic Bank & Trust (Kentucky) and Transportation Alliance Bank (TAB Bank) (Utah) to make installment loans of $2,500 to $10,000 with APRs up to 99.99% in several states that do not allow those rates on some or all loans in that size range. Enova also offers rent-a-bank lines of credit at rates that states do not allow.

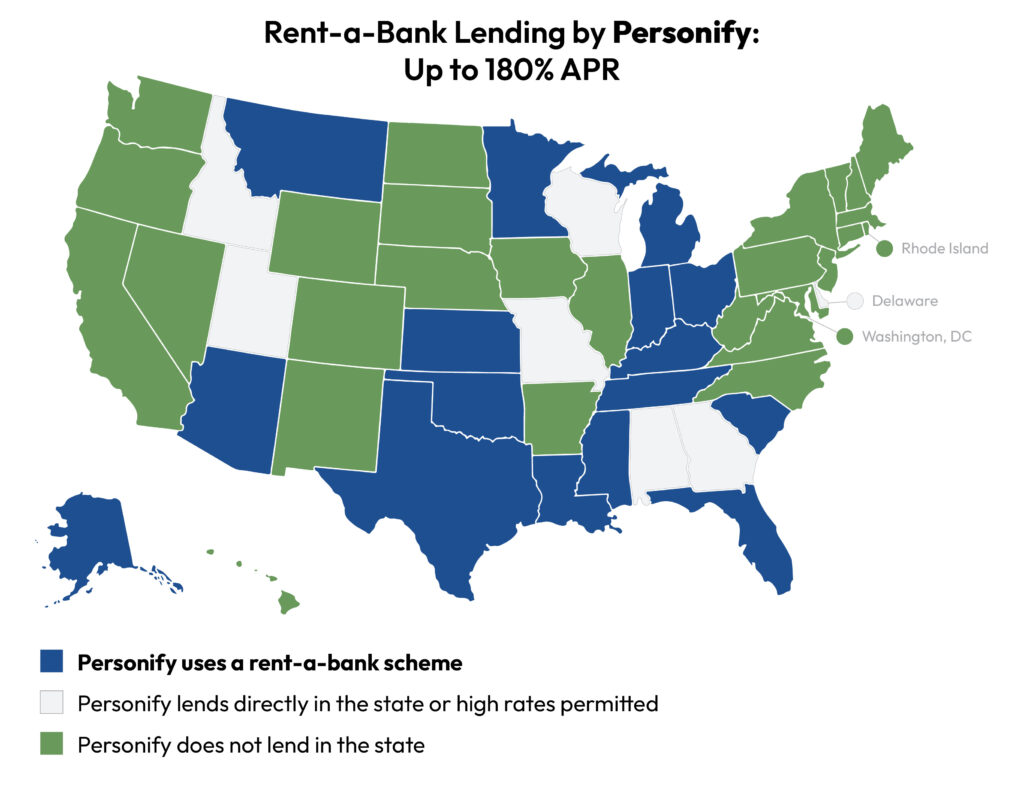

Applied Data Finance, doing business as Personify Financial uses First Electronic Bank, an FDIC-supervised industrial bank chartered in Utah (and owned by Fry’s Electronics), to enable installment loans of $500 to $10,000 with APRs as high as 179.99% in several states that do not allow that rate for some or all loans in that size range. Personify also lends directly in a number of states.

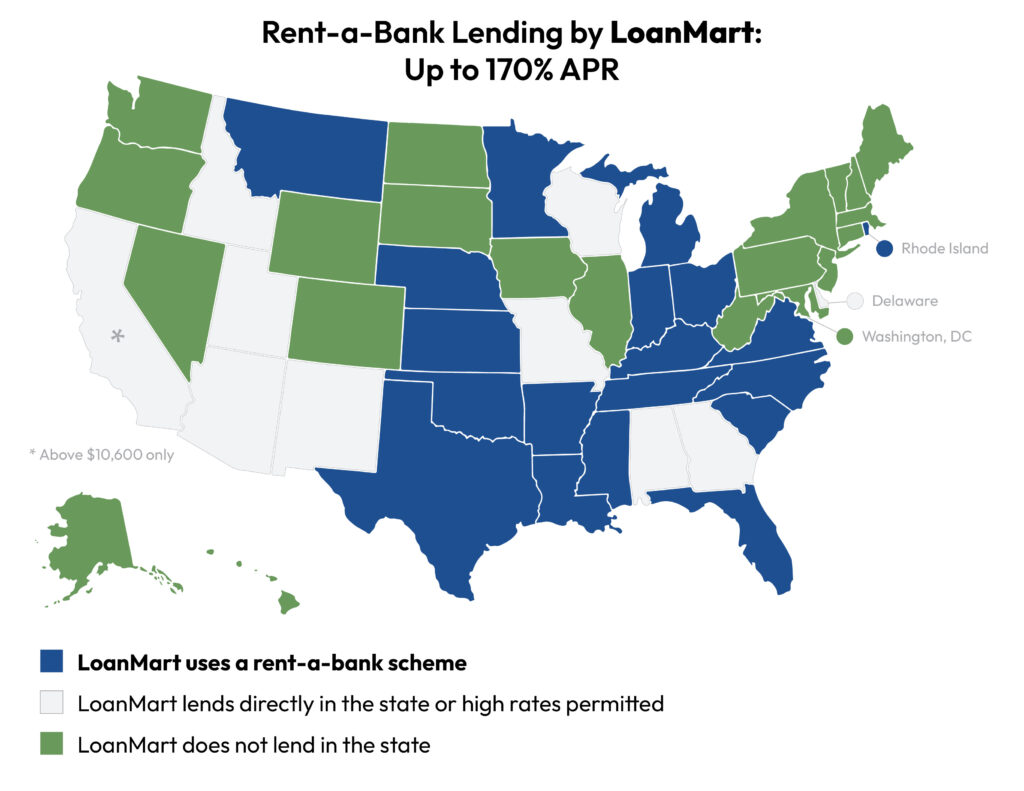

Wheels Financial Group, LLC dba LoanMart (under the ChoiceCash brand) uses FDIC-supervised Community Capital Bank (Utah) to make auto-title loans in several states, most of which restrict or disallow high-cost auto title lending. A sample loan formerly on LoanMart’s website was a 3-year, $3,000 loan at 170% APR with 36 monthly payments totaling $15,431.04. LoanMart also makes auto-title loans directly in a number of states. LoanMart does not operate in other states.

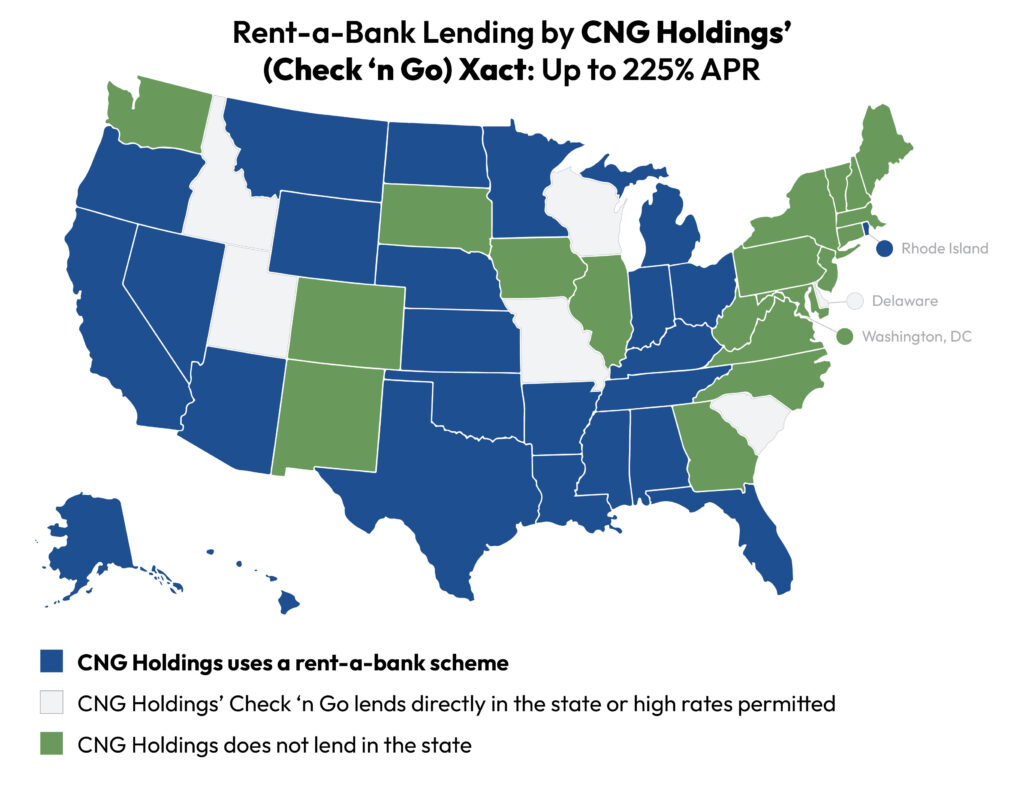

CNG Holdings, formerly Axcess Financial, the parent company of payday lender Check ‘n Go, offers the Xact installment loan through FDIC-supervised Capital Community Bank. The loans range from $1,000 to $5,000. Rates range from 145% APR to 225% APR. Xact loans are offered in several states that do not allow installment loans at those rates. CNG Holdings also directly offers high-cost installment loans in several other states.

Other Consumer Rent-a-Bank Lenders

CC Bank facilitates rent-a-bank installment loans up to 225% APR through a variety of payday and online lenders, including Balance Credit, Lendly, MoneyKey, Quickcredit, and Simple Fast Loans.

American First Finance offers installment loans through FinWise Bank at rates up to 155% APR for purchases at retailers selling furniture, appliances, home improvements, pets, veterinarian services, auto and mobile home repair, jewelry, and body art. American First Finance also directly offers retail installment contracts and lease-to-own in some states. Consumer complaints describing the predatory American First Finance loans facilitating by FinWise Bank are detailed in comments to the FDIC.

Integra Credit offers $500 to $3,000 at 149% to 199% APR through TAB Bank in several states that do not allow that rate.

See all resources related to: High-Cost Credit