In 2024, National Consumer Law Center advocates made strides to protect consumers from medical debt, junk fees, predatory loans, risky mortgages, hidden car costs, and many other unfair practices. Read below to learn more about our most significant work across our advocacy areas.

In November in Washington, D.C., Consumer Action presented NCLC with its Consumer Excellence Award in recognition of NCLC’s longstanding advocacy for consumers.

For more detail, click on the topic heading to see all our work in each area this year.

Auto Finance & Sales

🌟 NCLC has long advocated for greater transparency in car sales, so it applauded the FTC when it adopted its Combating Auto Retail Scams (CARS) rule at the end of 2023 after advocacy by NCLC and allies. When the threat of a Congressional Review Act (CRA) disapproval to overturn the rule arose in 2024, NCLC and a broad coalition of over 100 national and state organizations sent a letter to Congress expressing support for the rule. The rule, which will bring long overdue relief to car buyers who are frustrated by dishonest pricing, and will pave a path for the FTC to pursue future rulemakings to regulate car dealers to bring transparency and fairness to the process, was not overturned by CRA disapproval but still faces court challenges. NCLC and other consumer groups filed an amicus in support of the rule in a case filed by the National Auto Dealers Association which is being decided in the Fifth Circuit Court of Appeals.

NCLC and a coalition of consumer groups urged the Consumer Financial Protection Bureau (CFPB) to continue its efforts to improve the collection and dissemination of auto finance data, as part of its commitment to monitor the auto finance market for risks to consumers.

NCLC and other consumer groups filed an amicus brief in the U.S. District Court for the Southern District of New York in support of the CFPB and the New York Attorney General’s opposition to a motion to dismiss its case against Credit Acceptance Corporation (CAC). The brief supports the CFPB’s action based on allegations that CAC profits from transactions that are unnecessarily expensive and designed to fail, creating a perverse incentive to put consumers into harmful transactions. NCLC hopes the action encourages healthy access to credit to allow people to purchase cars they need but ensures both the consumer and the finance provider are motivated to see the consumer come out of the transaction having successfully paid for the car.

Banking, Payments, & Remittances

🌟 After urging the CFPB to take strong action on overdraft fees, advocates praised the CFPB for finalizing a rule to stop banks from extracting tens of billions of dollars from financially insecure account holders. The rule slashes typical fees for bank account overdrafts from $35 per transaction to just $5, saving the 23 million households who pay overdraft fees $5 billion a year, an average of $225 for households who pay overdraft fees. The CFPB’s overdraft rule ensures that the most vulnerable consumers are protected from big banks trying to pad their profits with junk fees.

NCLC advocates pushed for more oversight of digital wallets and payment apps and strongly supported a rule giving the CFPB oversight over Big Tech companies. We also highlighted the risks of nonbank banking and bank-fintech partnerships, and urged regulators to take more steps to use anti-money laundering rules to prevent payment fraud.

NCLC worked with over 50 consumer, civil rights, academics and privacy organizations in urging the CFPB to take meaningful actions to reduce and eliminate junk fees in international remittance transactions – fund transfers frequently used by immigrants to send money to their families abroad.

🌟 NCLC advocates urged Congress to strengthen fraud protection and applauded the introduction of the Protecting Consumers from Payment Scams Act, companion bills in the U.S. Senate and House of Representatives to protect consumers from fraud impacting payment apps and bank accounts. Advocates also supported a Federal Reserve Board proposal to speed up electronic payment on weekends and holidays.

Carla Sanchez-Adams, NCLC senior attorney, testified before the U.S. Senate Committee on Banking, Housing, and Urban Affairs on “Examining Scams and Fraud in the Banking System and Their Impact on Consumers.” Her testimony explained that payment fraud impacts all Americans across many communities. But the impacts of fraud are most keenly felt by certain vulnerable populations such as older Americans, low-income consumers, and people of color. 🌟 In December, the CFPB sued the owner of the bank payment app Zelle and three of the nation’s largest banks for failing to protect consumers from fraud in the peer-to-peer payment network.

Along with its advocacy for stronger consumer protections in the banking and payments system, NCLC published a revised, updated, and expanded edition of Consumer Banking and Payments Law (7th ed. 2024).”

Consumer Financial Protection Bureau

🌟Joining nine other organizations devoted to advocacy on behalf of consumers of financial services, NCLC filed an amicus brief urging the U.S. Supreme Court to reject arguments by payday lenders that the funding mechanism of the Consumer Financial Protection Bureau was unconstitutional. The Supreme Court agreed, delivering a major victory to consumers when it ruled 7-2 in favor of the CFPB’s funding mechanism, the latest and highest profile challenge in a long series of efforts to undermine the nation’s top consumer watchdog’s independent funding structure and its mission to protect consumers in the financial marketplace.

NCLC urged our supporters and allies to take action in support of the CFPB by writing letters to their members of Congress and submitting letters to the editor of local newspapers. The CFPB continues to face challenges in Congress.

Consumer Protections for Tenants

🌟 NCLC, along with Cohen Milstein and Greater Boston Legal Services, achieved a groundbreaking $2.275 million settlement on behalf of Massachusetts housing voucher recipients, resolving a lawsuit against SafeRent Solutions, a national tenant screening provider (formerly known as CoreLogic Rental Property Solutions). The lawsuit claimed that SafeRent’s algorithmic tenant screening score disproportionately harmed housing voucher recipients, including Black and Hispanic individuals, violating the Fair Housing Act as well as Massachusetts law protecting individuals based on their source of income and race. The settlement provides for significant injunctive relief to housing applicants who rely on vouchers and may be screened by SafeRent and requires a more robust evaluation of prospective housing voucher tenants’ eligibility for housing based on their full record rather than relying on a score derived through an algorithm.

🌟Advocates applauded the U.S. Department of Housing and Urban Development’s (HUD) Office of Fair Housing and Equal Opportunity for issuing strong and comprehensive guidance to protect rental housing applicants from discriminatory tenant screening practices that violate the Fair Housing Act.

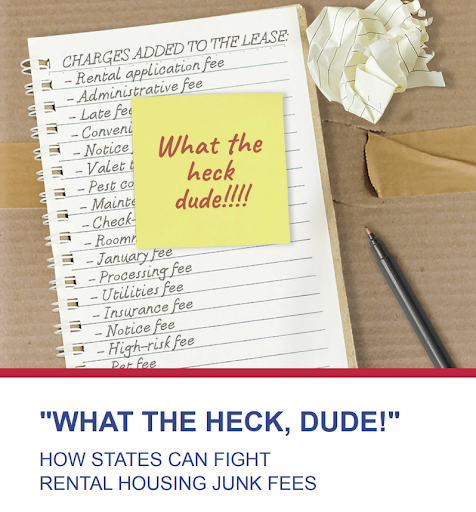

NCLC’s report, What the Heck, Dude! How States Can Fight Rental Housing Junk Fees examines the dizzying number of junk fees that renters face across the country, costing them hundreds of millions of dollars per year and pushing affordable housing out of reach.

Credit Reporting & Data Fairness

🌟 NCLC advocates applauded the Consumer Financial Protection Bureau (CFPB) when it issued two important Advisory Opinions to protect renters and workers from inaccurate background check reports and strengthen their rights to obtain their tenant screening reports under the Fair Credit Reporting Act (FCRA). The report came on the heels of a 2023 NCLC report, Digital Denials: How Abuse, Bias, and Lack of Transparency in Tenant Screening Harm Renters.

🌟 NCLC’s long-term advocacy to ban medical debt from credit reports made significant strides in 2024. The CFPB proposed a rule that would remove medical bills from most credit reports, increase privacy protections, help to increase credit scores and loan approvals, and prevent debt collectors from using the credit reporting system to coerce people to pay. The CFPB also released a study confirming NCLC’s contention that credit reporting of medical debt disproportionately harms Black and Latino families.

🌟The CFPB also issued a proposed rule under the FCRA to rein in data brokers, whose trafficking of information poses risks to national security, domestic violence survivors, immigrants, and consumers generally. The proposed rule also clarifies that personal identifiers, such as cell phone numbers and Social Security Numbers, derived from credit reports are still protected by the FCRA, something NCLC had urged the CFPB to do.

Past Imperfect: How Credit Scores and Other Analytics “Bake In” and Perpetuate Past Discrimination, an issue brief prepared by NCLC, looked at the racial disparities in credit scores and the deep structural factors behind them, while Even the Catch-22s Come With Catch-22s: Potential Harms & Drawbacks of Rent Reporting discussed measures to minimize the risks of reporting rent payment data.

Criminal Justice

An NCLC issue brief, Captive Concerns: Incarcerated People Face Obstacles to Reporting Consumer Abuses, looked at how, because of their limited and highly regulated contact with the outside world, incarcerated people struggle to report consumer problems such as identity theft and fraud, as well as abusive practices perpetrated by the private companies that they must rely on for essential services and goods within correctional facilities. Barriers to reporting these problems can render consumer protections toothless for this vulnerable population.

NCLC’s report Medical Debt Behind Bars: The Punishing Impact of Copays, Fees, and Other Carceral Medical Debt provides an overview of the carceral medical debt problem and policy recommendations to address the issue. The report provides background on the nature of carceral medical debt, including the complex healthcare needs of people who are incarcerated, what fees are assessed and why, how these fees impact health outcomes and lead to medical debt, how carceral medical debt affects families and reentry, and private equity and for-profit contractors’ roles in this problem.

🌟NCLC filed comments supporting changes to Medicaid and Medicare program rules that would increase access to healthcare for justice-involved people. The final rule approved these critical changes, which means that more than 340,000 people over 65 who are on probation and parole–in addition to others subject to other forms of community supervision–will now qualify for Medicare. This victory reduces the risk of people either foregoing medical care or incurring significant medical debts–either of which could impede successful reentry.

🌟It’s been a year since NCLC advocates helped pass a law making communications free for people incarcerated in Massachusetts and their families. The law has already made a huge difference: phone calls more than doubled in the state prison system over the past year, and calls from most county jails went up by about 133%. NCLC’s work means low-income Massachusetts families can stay connected with their incarcerated loved ones, setting them up for successful reentry.

Debt & Bankruptcy

🌟NCLC advocates worked to promote widespread implementation of a new guidance from the Department of Justice and Department of Education that significantly increased the number of consumers who have used bankruptcy to eliminate or reduce their student loan debt. This work included an updated issue brief, New Process to Discharge Student Loans in Bankruptcy and a session at the annual NCLC/NACA Consumer Rights Litigation Conference. Over 75% of those consumers who have tried the new process have received a full or partial discharge of their student loans.

🌟NCLC took several major steps to address coerced debt, a form of economic abuse, often affecting survivors of domestic violence or older adults, and an avenue for abusers to limit the economic independence of an individual. In May, NCLC issued a Model State Coerced Debt Law that states can enact to address coerced debt. Then, along with the Center for Survivor Agency and Justice, NCLC submitted a petition to the CFPB urging rulemaking on coerced debt. In response, the CFPB issued an Advanced Notice of Proposed Rulemaking on coerced debt and financial exploitation of domestic violence survivors and older Americans.

NCLC partnered with Justice in Aging to produce the report Nursing Homes Aggressively Pursue Family Members and Friends When Residents’ Bills Go Unpaid, Often Violating the Law. The report reveals that despite federal law prohibiting nursing homes from requiring a third party to guarantee payment of their loved one’s bill, nursing homes still frequently pursue payment from friends and family.

Our 2024 No Fresh Start report documents that not one state or jurisdiction sufficiently protects its residents’ homes, vehicles, belongings, and family finances from seizure by debt collectors. Improvement to state laws protecting these assets is particularly important as families continue to struggle through a perfect storm of historically high inflation, all-time high credit card interest rates, an ever-growing cascade of junk fees, and record-breaking consumer debt. The report provides recommendations for strengthening exemption laws in the states.

🌟In a class action lawsuit challenging rent-to-own contracts, the Fourth Circuit U.S. Court of Appeals ruled in NCLC’s favor, reversing a district court’s dismissal of the case Bland v. Carolina Lease Management Group. The case, involving rent-to-own contracts for storage sheds, alleges that the interest being charged is more than twice what North Carolina law allows and that the defendants engaged in unfair and deceptive practices by willfully violating the statutory interest rate cas and engaging in unlawful debt collection.

Energy, Utilities, & Telecommunications

🌟Advocates welcomed newly adopted energy codes for federally supported homes across the country. The significant update from the U.S. Department of Housing and Urban Development (HUD) and Department of Agriculture (USDA) will reduce housing costs, default risks to lenders, and greenhouse gas emissions and other pollution. NCLC has been urging the adoption of energy efficiency standards for new homes backed by Fannie Mae and Freddie Mac.

NCLC advocates contributed a chapter to the new book, What’s Possible: Investing NOW for Prosperous, Sustainable Neighborhoods, which recommends consumer protections for energy-efficiency financing to ensure that all households can meet their energy needs without financial risk.

NCLC convened the second Energy Justice Exchange, hosted at the North Carolina Justice Center in Raleigh, N.C. Energy advocates and housing advocates from the Southeast and around the country gathered to discuss challenges and strategies for advancing energy affordability.

Community Solar: Expanding Access and Safeguarding Low-Income Families, an NCLC report, looked at existing community solar models, best practices, and state policies, and provided states with model community solar consumer protections to ensure equitable outcomes for low-income participants. 🌟 Advocates also applauded a coordinated agency effort of the U.S. Treasury, Federal Trade Commission (FTC), and the CFPB to help consumers navigate the complicated marketplace of products and financing options and make the solar marketplace safer for consumers.

Regarding rooftop solar installations, NCLC issued consumer protection recommendations for rooftop solar sales, and worked in coalition with our consumer advocate partners seeking additional protections from unfair and abusive practices in the rooftop solar industry from the CFPB and other federal agencies.

Protecting Access to Essential Utility Service During Extreme Heat and Climate Change, written by advocates at NCLC and the Center for Energy, Poverty, and Climate, outlines specific actions policymakers and regulators must take to address the unaffordability of essential utility service during extreme weather and the need for year-round access.

Advocates also produced a guide to Inflation Reduction Act Home Energy Rebates to outline issue areas that advocates for low-income consumers and tenants should prioritize when providing stakeholder input into the state rebate plans.

🌟At the state level, NCLC won for our low-income clients a reduction in late payment fees in Louisiana and 🌟a new tiered discount rate in Massachusetts. 🌟 Advocates also made gains in efforts to enhance data collection and reporting and implementation of bill affordability programs. NCLC advocated for affordable utility service in states transitioning away from gas utility service, and pressed for strong consumer protections from predatory energy supply sales. 🌟 And after several years of advocacy, the governor of Massachusetts signed into law the creation of a new fund for intervenor compensation in utility proceedings.

Equity & Racial Justice

🌟 Following a petition NCLC filed with the the Consumer Financial Protection Bureau (CFPB) in 2023, the CFPB proposed rules that would ensure that borrowers with limited English proficiency (LEP) have a meaningful opportunity to seek assistance from their mortgage companies in times of distress, helping them stay in their homes. (The final rule has not been issued yet, and its fate is uncertain in the new administration.)

NCLC published a sweeping report detailing the ways that financial institutions across the financial services industry serve, or fail to serve, people with limited English proficiency. The report, “Cracking the Code: Understanding and Overcoming Language Barriers in Consumer Finance,” recommends policy changes to require improvements in three high-impact areas: consumer reporting and tenant screening, debt collection, and loan servicing.

🌟 Also in the language access arena, NCLC advocates praised the Federal Housing Finance Agency (FHFA) for formalizing its requirement for lenders to collect, maintain, and report borrower language preference in its final rule on fair housing, fair lending, and equitable housing finance. The rule, which also codifies FHFA’s fair lending oversight, establishes its supervision authority for unfair or deceptive acts or practices, and formalizes its requirement for lenders to collect, maintain, and report borrower language preference, will provide greater market access to underserved communities.

High-Cost Credit

🌟Advocates urged action on credit card late fees and praised the CFPB’s final rule reducing most fees to $8 to stop banks from raking in billions of dollars from excessive late fees. We offered support for the CFPB’s Interpretive Rule on Buy Now Pay Later loans, while calling for additional consumer protections. An NCLC issue brief, New Rights for Buy Now, Pay Later Purchases, explains the new dispute and disclosure rights BNPL users now have, while warning consumers of continuing risks.

NCLC published two 50-state reports on laws to prevent predatory lending. Larger Loans Need Lower Rates: A 50-State Survey of the APRs Allowed for a $10,000 Loan surveys the interest rates and loan fees allowed by the 50 states and the District of Columbia for an unsecured 5-year installment loan of $10,000. Predatory Installment Lending in the States: How Well Do the States Protect Consumers Against High-Cost Installment Loans? looks at two smaller sample loans, a 6-month $500 loan and a 2-year $2,000 loan. It finds that while 45 states and the District of Columbia currently cap interest rates and loan fees for loans of this size, interest rate caps still vary greatly from state to state, rates are trending upward, and too many states allow lenders to pile on junk fees.

🌟 NCLC worked on a number of fronts to stop new high-cost fintech payday loans. We worked with 192 labor, consumer and other groups to oppose a bill to exempt “earned wage access products” from the Truth in Lending Act. We urged and applauded CFPB action to address evasions by fintech payday lenders that hide the cost of 300% annual percentage rate (APR) loans. We supported enforcement actions by the CFPB against SoLo Funds and by the District of Columbia Attorney General against EarnIn for disguising the cost of loans through purportedly voluntary “tips.”

🌟 Advocates continued to update NCLC’s High-Cost Rent-a-Bank Loan Watch List throughout the year, including when EasyPay agreed in a settlement with Attorney General Andrea Campbell to pay restitution, end all efforts to collect on active and defaulted loans, and leave Massachusetts. We submitted extensive comments urging the Office of the Comptroller of the Currency, the Federal Reserve, and the Federal Deposit Insurance Corporation to end predatory bank-fintech partnerships involving rent-a-bank lending.

NCLC supported a federal bill to cap interest rates at 36%.

NCLC took the lead on consumer group comments in support of the CFPB proposal to limit credit card late fees to $8 and joined a coalition letter to President Biden and the CFPB supporting lover credit card late fees.

In November, NCLC released its annual report, Predatory Installment Lending in the States: How Well Do the States Protect Consumers Against High-Cost Installment Loans? (2023)

NCLC testified at a CFPB field hearing and submitted comments to the CFPB, HHS, and Treasury expressing our appreciation for their engagement in an extensive examination of medical payment products and their impact on vulnerable consumers. NCLC’s April 2023 report Health Care Plastic: The Risks of Medical Credit Cards discusses one type of medical payment product–medical credit cards–in depth, presents the results of a survey of legal services attorneys, private attorneys, and other advocates regarding their clients’ experiences with medical credit cards, and concludes with recommendations.

Homeownership & Foreclosure Prevention

🌟 NCLC successfully advocated for the U.S. Department of Veterans Affairs (VA) to expand foreclosure relief for military veterans in its Home Loan Guaranty Program. In April, VA released its new foreclosure alternative, the VA Servicing Purchase (VASP). Under VASP, VA will purchase loans after servicers bring them current with specific loan modification terms.

🌟 NCLC secured critically important borrower protections recently announced by the U.S. Department of Housing and Urban Development (HUD) to help avoid unnecessary foreclosures on loans sold in bulk sales of FHA-insured loans. These provisions address many concerns that NCLC has raised since 2012, when HUD significantly expanded the loan sale program, including in a groundbreaking report on the program.

🌟 After many years of advocacy for important consumer protections for borrowers with Property Assessed Clean Energy (PACE) loans, NCLC welcomed a final rule from the CFPB that provides significant protections. These protections will be particularly important for borrowers in California and Florida, where PACE loans have proliferated.

🌟 NCLC successfully advocated for a groundbreaking law in Massachusetts to reduce the risk of residents losing their homes to property tax foreclosure, a problem that disproportionately affects older adults with low or fixed incomes and Black and Latino households. Massachusetts was among the first states to revise its out-of-date state laws after the 2023 U.S. Supreme Court ruling in Tyler v. Hennepin County holding that it is unconstitutional for a local government to take a property in a tax foreclosure and keep the excess surplus after the tax debt and costs are paid.

🌟In March, a federal court gave final approval to a settlement agreement between the owners of Indian Creek Mobile Home Park in Garner, N.C., and a class of tenants/home purchasers. The settlement resolves the class action challenge to the “rent-to-own” scheme perpetuated by the owners of the mobile home park. Filed in October 2021 by the North Carolina Justice Center and NCLC against Riverstone Communities, the lawsuit alleged that the installment purchase contracts they provided to mobile home park residents were set up to evade consumer and tenant protections.

NCLC provided persuasive testimony on needed policy reforms at a CFPB field hearing on land contracts and lease-options, predatory products that create a mirage of homeownership but actually drain wealth from low-income neighborhoods and communities of color and increasingly target immigrant communities.

🌟 NCLC comments influenced a final rule from HUD regarding the Indian Home Loan Guarantee Program, adding important protections including significant changes to help borrowers avoid foreclosure.

🌟After advocating for increased protections for older adults with reverse mortgages, NCLC advocates cheered an announcement from HUD clarifying that premium pricing – charging a higher interest rate in exchange for an up-front credit – is not permitted in the HUD’s reverse mortgage home purchase program. HUD modified its proposed rule allowing interested-party contributions for certain reverse mortgage loans to bar contributions from lenders and loan originators, while still permitting contributions from sellers and other third parties.

Together with Colorado Legal Services, NCLC sued mortgage lender Unison Agreement Corp. and its affiliates. The case, Stone v. Real Estate Equity Exchange, Inc., Unison Agreement Corp., Odin New Horizon Real Estate Fund, and Unison Investment Management, LLC, seeks a ruling that so-called “shared equity option products” are, in fact, usurious and unconscionable mortgage loans that illegally strip home equity for vulnerable homeowners in violation of Colorado consumer protection laws. of avoiding unnecessary foreclosures for Native American borrowers.

Medical Debt

🌟In California, NCLC was part of a broad coalition that cosponsored a bill to ban medical debt from credit reports. The California governor signed the bill into law in September, helping millions of Californians. NCLC also provided technical support to advocates in a number of other states that passed similar medical debt credit reporting laws, bringing the total of such states to nine.

Robocalls & Texts

Years of advocacy to protect consumers from unwanted and dangerous calls and texts paid off on several fronts this year. 🌟NCLC’s advocacy led to the adoption in late 2023 of a bold and aggressive new regulation — a game changer — to stop 1.4 billion illegal and annoying telemarketing calls made every month to U.S. telephones. The new regulation requires one-to-one consent for these calls, closing what is known as the “lead generation loophole.” NCLC led a coalition of consumer and privacy advocates defending the FCC’s regulation before both the FCC and in the 11th Circuit, which is considering the industry’s challenge to the rule.

NCLC has also been trying to convince the FCC to protect subscribers against fake caller IDs, which is facilitated by the practice of voice service providers renting the temporary use of numbers to telemarketers and scammers. Recently, this advocacy has been joined by multiple state utility commissions.

The growing use of AI-generated voice in robocalls and texts prompted the FCC to request comments on appropriate measures to protect consumers. NCLC led a group of 26 national, state and local consumer and privacy advocates urging the FCC to require specific consent and in-call disclosures of AI in interactive conversations. This coalition also vehemently opposed a proposal that would permit telephone providers to deploy AI technology that enables network level surveillance of all calls.

Working with bank trade associations and others, NCLC has urged the FCC to apply regulatory protections to eliminate bank imposter texts, which cost consumers hundreds of millions of dollars every year. NCLC met several times with the OCC (the federal regulator of national banks) to discuss how it could assist in these efforts.

🌟In another victory, the Federal Trade Commission approved amendments to its Telemarketing Sales Rule to cover “inbound” telemarketing call scams that entice consumers to call for technical support but lead to theft – particularly from older adults. Consumers 60 and older are five times more likely than younger people to report losing money in a tech support scam, and in 2023, older consumers reported more than $175 million in losses to tech support scams.

NCLC and the Electronic Privacy Information Center (EPIC) filed comments on behalf of a coalition calling for the FCC to issue substantially stronger rules to protect cell phone users from SIM swap and port-out frauds. These types of fraud occur when scammers who target data and personal information covertly swap a cell phone’s SIM card or port a phone number to a new carrier – actions they can carry out without ever gaining physical control of a consumer’s phone.

Student Loans

NCLC advocates created a new Student Loan Toolkit, a free online resource to help borrowers navigate the student loan system and manage their debt. It includes fillable pages so borrowers can record their information and chart their progress toward becoming debt-free. It’s also a resource for financial counselors, legal aid attorneys, and other advocates who advise borrowers on the options and strategies for their loan situation.

NCLC student loan advocates continued their work examining the companies that service federal student loans and how the contracts governing their work shape servicer accountability and borrower experience. NCLC advocates published a report about federal student loan servicers and how new dramatically overhauled contracts will change borrowers’ experiences. New Federal Student Loan Servicing Contracts, New Promises discusses the ins and outs of the new contract and the provisions that are most relevant to student loan borrowers’ rights and experiences.

Along with Student Borrower Protection Center & Selendy Gay PLLC, NCLC filed a lawsuit under the D.C. Consumer Protection Procedures Act against the Higher Education Loan Authority of the State of Missouri (MOHELA), the giant student loan servicing company. The suit alleges that MOHELA has illegally overcharged borrowers on their monthly student loan bills, failed to timely process paperwork, and actively misled borrowers about their student loan accounts.

Advocates detailed policy solutions to address the growing number of adults age 60 or older still burdened by student loan debt, and worked with the Department of Education to examine ways to ensure that Social Security benefits needed to avoid poverty are protected against student debt collection. Some older adults took out debt to help family members attend college, but most are still in debt from their own education, and most are worse off financially than those who never attended college. A fact sheet from NCLC and New America outlines ways to reduce the burden of student debt on older adults and to protect the nearly 800,000 borrowers 62 and older with loans in default, who are at risk of having their tax refunds, wages, and Social Security payments seized in 2025.

🌟 Millions of student loan borrowers have struggled for decades with affordability and access to income-driven repayment plans that provide a pathway to eventually being debt free. NCLC advocates fought to defend the new, more affordable Saving on a Valuable Education (SAVE) payment plan and the longstanding promise of debt relief at the end of twenty years in repayment, filing an amicus brief in the U.S. Court of Appeals for the Eighth Circuit providing the legislative history and purpose of statutes authorizing such plans. While defending this progress, NCLC advocates also celebrated the news that 1.4 million borrowers had their remaining loans cancelled through income-driven repayment plans as a result of critical program fixes that NCLC advocated for.

NCLC student loan advocates participated in rulemakings related to postsecondary school accountability and student debt relief, including serving on Department of Education rulemaking committees and submitting detailed comments on behalf of the legal aid community.

The student loan landscape shifted constantly in 2024, and NCLC advocates provided continuously updated information to legal aid lawyers, private attorneys, and borrowers about updates to the student loan landscape on NCLC’s Student Loan Borrower Assistance website, in updates to the Student Loan Law treatise, as well as through monthly legal aid trainings. Additionally, NCLC provided both in-depth multi-day training and monthly training sessions for advocates in California as part of the California Department of Financial Innovation & Protection’s Student Loan Empowerment Network.

Support NCLC

Please support NCLC's work to advance consumer rights and economic justice with a tax-deductible contribution today!

Donate