Consumers who wish to borrow small amounts of money may have several options. Comparing them can be difficult, especially since consumers do not always get annual percentage rate (APR) disclosures.

The APR is an important price comparison tool, providing an apples-to-apples rate comparison for borrowing the same amount of money for the same amount of time. Some critics claim that the APR is not relevant to short-term loans that will not be taken out for an entire year. Yet the APR is a rate, not a dollar cost, and is useful regardless of the length of the loan, just as miles-per-hour is a standard measure of speed even if you are not traveling for a full hour.

Rate comparisons are useful because cost alone does not account for how much credit the consumer is getting for how long. Whether $20 for a taxi ride is a lot or a little depends on whether you are going one block or 10 miles. APRs help consumers understand that borrowing $100 for one month with a 360% APR payday loan will cost 10 times more than doing so with a 36% APR loan. That APR disparity is especially relevant for short-term loans because they often lead to repeat borrowing and a long-term debt trap, costing far more than the price of a single two-week loan.

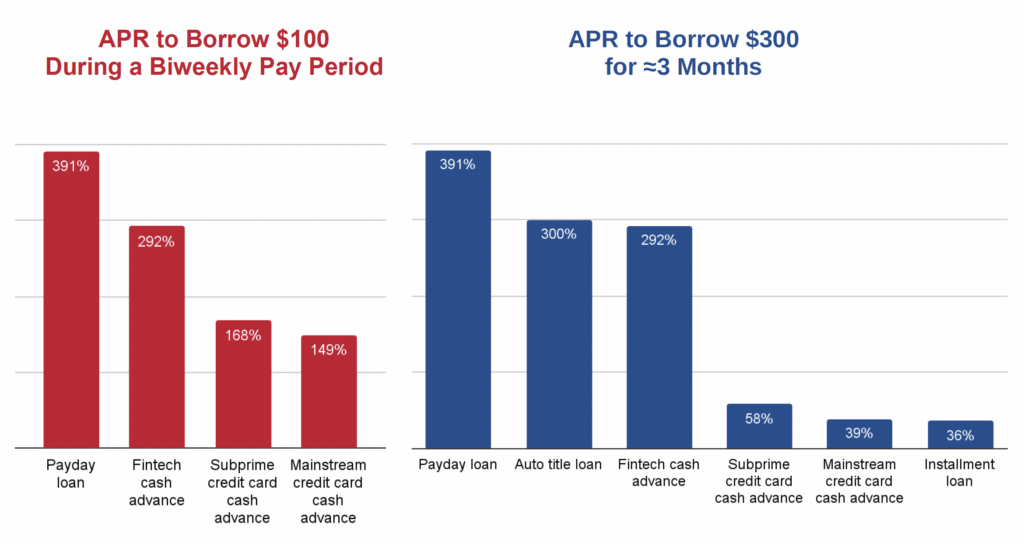

The two charts below compare the APRs for different options in two scenarios: borrowing $100 once during a biweekly pay period, and borrowing $300 that is repaid after about three months. The APRs are based on assumptions described in the methodology section below. Different assumptions would lead to different APRs.

Methodology and Technical Comments

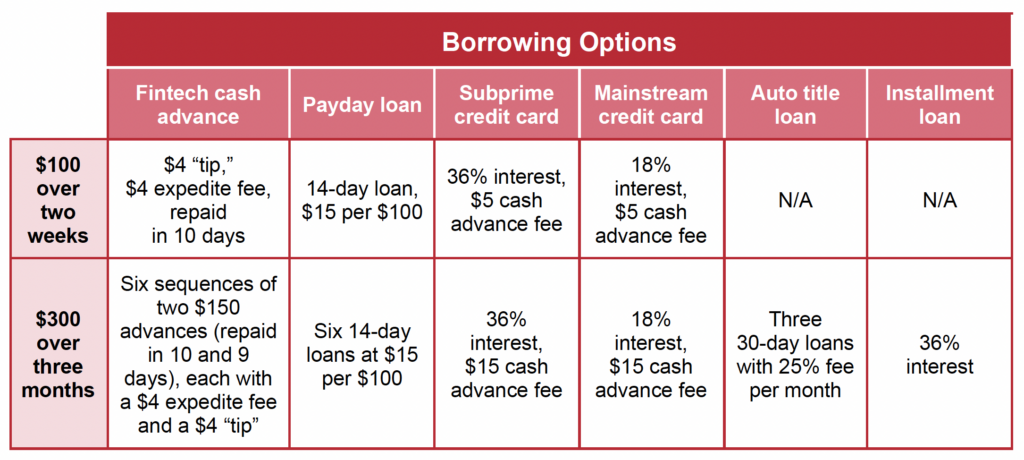

The graphs above compare the APRs for different borrowing options that a consumer could use under two scenarios: borrowing $100 for about two weeks, and borrowing $300 for about three months. The following table explains the assumptions made for each type of loan.

The amount of time the advance is outstanding before it is repaid is not identical for each scenario in order to match as much as possible the way these options would work in the real world. For example, payday loans are typically outstanding for 14 days, whereas fintech cash advances are typically repaid in 10 days. APRs under different time and cost assumptions are provided for some alternatives below. The APRs in the charts, which reflect all costs, may also differ from the APRs disclosed by lenders as a result of evasions by lenders or loopholes in APR disclosure rules.

Cost of Borrowing $100 for About Two Weeks

1. Payday Loan

The example assumes a 14-day payday loan with a cost of $15 per $100 borrowed. The APR is 391% and the cost is $15.

2. Fintech cash advance (e.g., direct-to-consumer earned wage advance)

The example is for a direct-to-consumer “earned wage” cash advance taken out 10 days before payday, repaid on payday, with a tip and expedite fee that together total $8 – i.e. a $4 expedite fee and $4, or an $8 expedite fee and no tip, or a similar combination.

(The APR for an employer-based earned wage advance would likely be different and potentially lower. Employer-based earned wage advances do not solicit “tips” and have different fees. The Consumer Financial Protection Bureau found that, based on average data inputs in a sample of employer-partnered earned wage advances, an illustrative APR equates to 109.5%. However, a study by the California Department of Financial Protection and Innovation based on more granular transaction data found that companies that do not solicit tips (typically the employer-based providers) had an average APR of 331%.)

The fintech cash advance example assumes that the advance is taken out on day four of a biweekly pay period, that the worker has worked enough to earn at least $100 since the last payday, and that the advance is repaid on payday 10 days later. The example uses a 10-day repayment period because an advance based on earned wages cannot be taken out until some wages have been earned, and 10 days is the average time for those advances found by the California Department of Financial Protection and Innovation.

Under these assumptions, the APR is 292% and the cost is $8. The APR is higher than for a 14-day advance because the consumer receives less credit – 10 days instead of 14. If the advance were repaid in 14 days, the APR would be 209%.

3. Subprime Credit card: 36% with $5 cash advance fee

The example assumes that the credit card carries 36% interest and charges a $5 cash advance fee for a $100 advance. Interest on both the cash advance and the cash advance fee begins accruing immediately, for a total of $1.45 in interest. The total cost is $6.45 and the APR is 168%.

4. Mainstream Credit card: 18% interest, $5 cash advance fee

The example assumes that the credit card carries 18% annual interest and charges a $5 cash advance fee for a $100 advance. Credit card lenders do not allow a grace period for cash advances, so interest on both the cash advance and the cash advance fee begins accruing immediately. The interest is $0.72. The total cost is $5.72 and the APR is 149%.

Cost of Borrowing $300 for About Three Months

1. Payday loan

In this example, the consumer takes out a 14-day payday loan, repays it, and then immediately reborrows five times for a total of six loans over 84 days. The cost for each loan is $15 per $100 borrowed, which comes to $45 for a single $300 loan and $270 in total for the six loans. The APR is 391% for each individual loan in the series, and for the 84-day series as a whole.

2. Auto title loan

In this example, the lender charges a 25% fee per month for a 30-day loan. For a $300 loan, the consumer repays the loan and immediately reborrows twice, for a total of $225 in fees. The APR is 300% for each individual loan in the series, and for the 84-day series as a whole.

3. Fintech cash advance (e.g., direct-to-consumer earned wage advance)

The example is for a direct-to-consumer “earned wage” cash advance app. Fintech cash advance providers typically allow a maximum advance of $100 to $150 per day, even though they permit multiple loans per week. Therefore, to get $300, the example assumes that the consumer takes out two $150 advances on successive days. The first advance is taken out on day four of a biweekly pay period and is repaid in 10 days. The second advance is taken out on day five and is repaid in 9 days. Thus, the average repayment period is 9.5 days.

The example assumes that, after the first set of advances is repaid, the consumer waits four days to accrue additional earned wages before beginning the cycle of reborrowing again, completing six cycles of two $150 advances.

The example assumes that the consumer pays a $4 expedite fee and a $4 tip for each advance, for a total of $16 in fees for each biweekly sequence of $300 in advances.

The APR for each sequence of two advances is 205%. With six such sequences over three months, the total cost is $96 and the consumer receives 57 days’ worth of credit (spread out over 90 days), which also has a 205% APR for that 57-day period.

But the cost and APR could be higher at some providers.For example, some providers have a maximum advance of $100, requiring three advances to obtain $300 in credit, and charge a $9 expedite fee for each $100 advance. Even without any tip, the APR for three $100 advances with a $9 expedite fee repaid on average in 10 days would be 329% APR.

Employer-based earned wage advances do not solicit “tips,” have different fees, and typically allow larger advances, so their APRs would differ.

4. Subprime Credit card with 36% interest, $15 cash advance fee

The assumptions are the same as for the 18% credit card except the interest rate is 36%, generating $27.18 in interest over three months in addition to the $15 cash advance fee, for a total cost of $42.18 and an APR of 58%.

5. Mainstream Credit card with 18% interest, $15 cash advance fee

In this example, the cash advance fee is the greater of $5 or 5% of the advance, so the fee is $15 for a $300 advance. The annual interest rate is 18%, begins accruing immediately, and applies to the cash advance fee. Each month, the consumer pays the minimum of 1% of the balance plus the finance charges. (Credit cards may have a minimum payment of $25 or higher. But the example assumes that the consumer is a revolver (carrying a balance month to month) who is already making a minimum payment toward a previous balance. So the cash advance only increases the minimum payment by 1% of the additional balance.) The interest paid over the three months is $13.59, in addition to the $15 cash advance fee, for a total cost of $28.59 and an APR of 39%.

6. Installment loan with 36% interest

This example assumes a $300, 3-month installment loan with 36% interest and monthly payments of $106.06. The total cost is $18.18 and the APR is 36%.

See all resources related to: High-Cost Credit