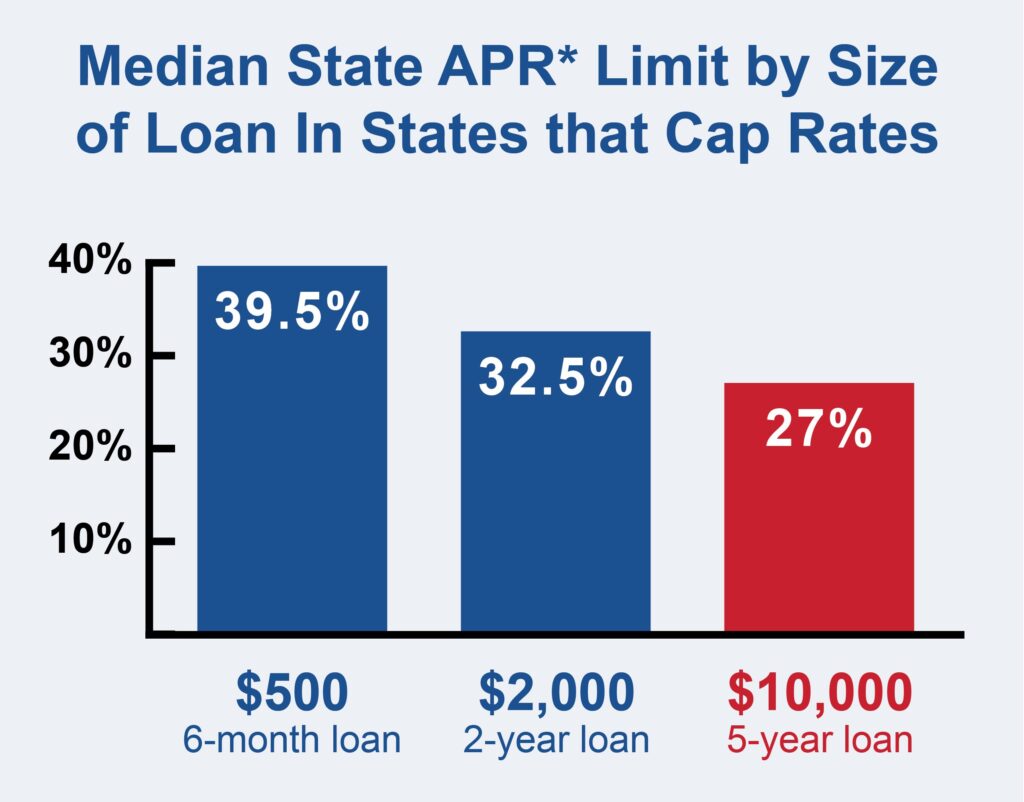

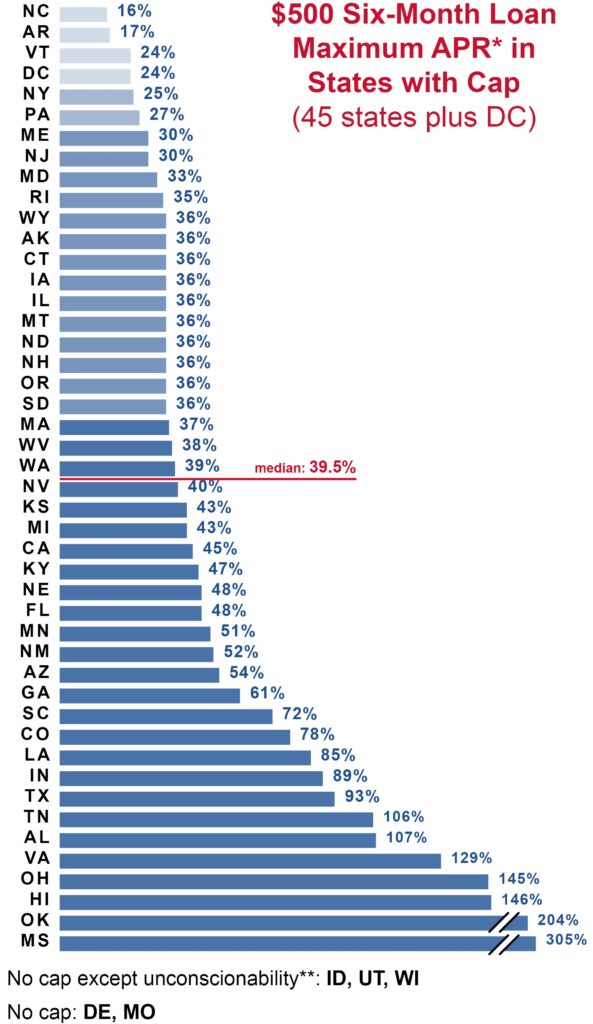

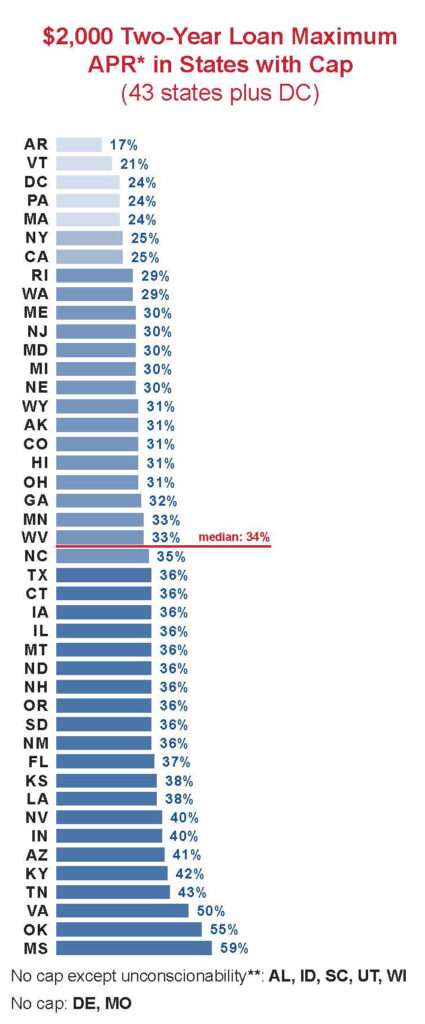

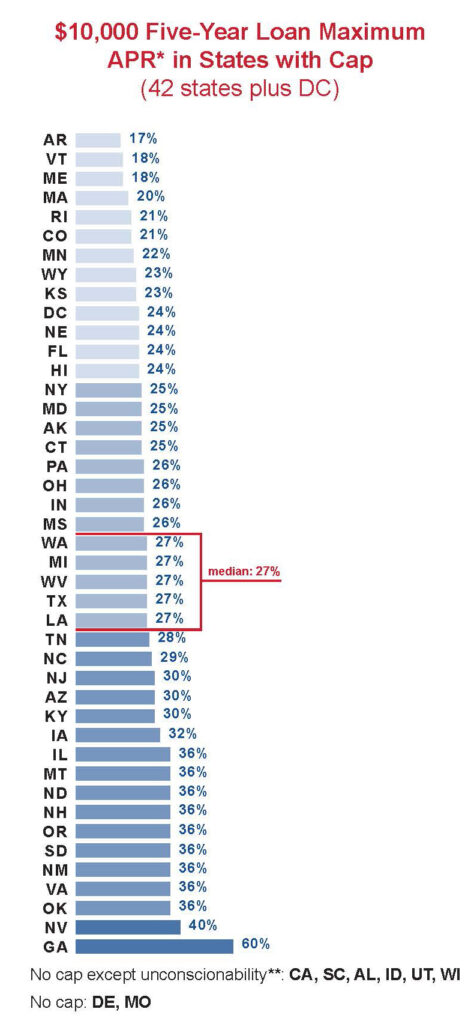

Rate limits are the simplest and most effective protection against predatory lending. Almost all states cap the maximum annual percentage rate (APR) on small- to mid-size installment loans: 45 states and DC cap the rate on a $500, six-month loan; 43 states plus DC do for a $2,000, two-year loan; and 42 states plus DC do so for a $10,000, five-year loan.

A 36% APR cap is a widely-accepted maximum rate for small loans, and most states cap rates at or near that level for a $500 loan. But for larger loans, 36% is a very high rate, and most states appropriately have lower caps. Raising the rate from 25% to 36% adds over $4,000 to the cost of a $10,000, five-year loan.

Voters of all stripes strongly support rate caps. In recent years, overwhelming bipartisan majorities of voters supported rate caps of 36% or less in Arizona, Colorado, Montana, Ohio and South Dakota.

Some states have no rate cap at all. Depending on the size of the loan, three to six states only prohibit unconscionability, and two (Delaware and Missouri) have no limit whatsoever.

* Annual percentage rate, including fees, for closed-end, unsecured loans made by licensed non-bank lenders, current as ofOctober 2024 for the $500 and $2000 loans and current as of August 2023 for the $10,000 loan. Rates for open-end lines ofcredit may vary.

** Unconscionability refers to rates that are so high that they shock the conscience.

See all resources related to: High-Cost Credit