Key Points

In 2015, more employees are expected to receive wages on payroll cards than by paycheck. By 2019, an estimated 12.2 million workers will receive their wages via payroll cards, compared to only 2.2 million who will get paper paychecks, according to Aite Group. With this fast-growing trend, states can be leaders in setting the standard for strong payroll card programs. Payroll cards can be a safer, faster, more convenient, and cheaper way to receive wages than a paper paycheck. However, payroll cards that are loaded with fees can chip away at thin wages.

Not a single state that uses payroll cards asks the card issuer to provide data on the fees that its employees pay, which is unacceptable. Every state payroll card is theoretically capable of being used for free if the worker is careful. But it is impossible to know if a payroll card is causing low wage workers to lose their pay to fees unless the state asks for the data, which is easily available.

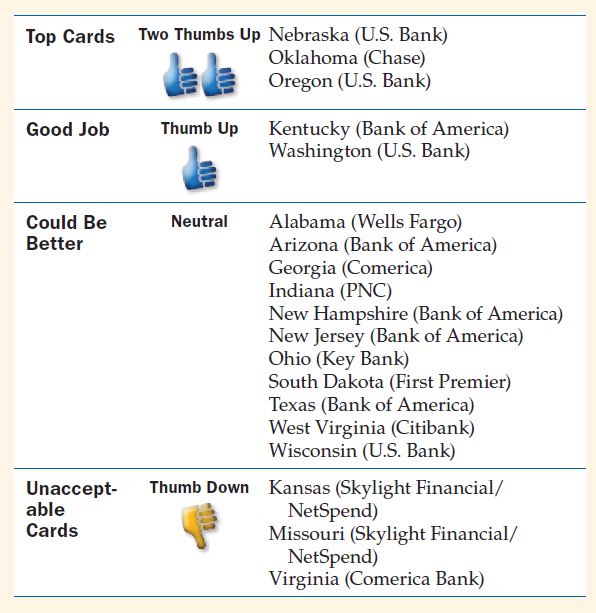

Rating the cards based on the fee schedules, the payroll card programs in many states are a positive role model, and others can join that group with only modest improvements. Three states – Nebraska, Oklahoma and Oregon — receive our top, Two Thumbs Up rating by providing cards that are easy to use without incurring fees. The Kentucky and Washington cards also have few fees and rate One Thumb Up.

The Kansas and Missouri cards, provided by NetSpend’s Skylight Financial division, received a “Thumb Down” rating because they can impose $25 overdraft fees on workers. The Virginia payroll card also received a negative rating for the large number of fees that most other cards do not have.

Payroll cards that have the bare minimum of fees will help workers keep every hard-earned cent and will reduce the costs of paper paychecks by giving workers the confidence to use payroll cards.

Recommendations

- Both public and private employers should always give employees the first choice of direct deposit to an account of their choosing, before enrolling the employee in a payroll card. Payroll cards, along with paper paychecks if the payroll card poses a hardship, should be a secondary method of pay.

- Employers should choose payroll cards that employees can easily use for routine purposes for free. Cards should be designed with minimal or no fees for getting cash, spending money, accessing account information, and overdrafts or penalties.

- Employers that use payroll cards should demand regular reports on the fees that employees are incurring. Action should be taken to renegotiate fee schedules or educate employees on how to use the cards to avoid fees.

- State legislators and regulators should adopt or strengthen payroll card laws. States should require free access to wages at network ATMs and should ban overdraft and other fees. NCLC and Consumers Union have drafted a state model payroll card .

- The Consumer Financial Protection Bureau should adopt rules to bolster employee choice and to ban problematic fees on payroll cards. The CFPB should ban overdraft fees, legal process fees, research fees, balance inquiry fees, and customer service fees, among others.

- The CFPB should finalize its proposal to improve transparency and competition in the payroll card market by requiring all fee schedules to be available to the public on the CFPB’s website.

- Employers should provide an option for paper paystubs.

2015 State Government Payroll Card Ratings

(See Executive Summary for criteria for ratings)

See all resources related to: Banking, Payments & Remittances