The Consumer Financial Protection Bureau (CFPB) is the only federal consumer protection agency with a statutory mandate to protect the financial wellbeing of servicemembers and veterans. It has obtained over $185 million in relief as a result of enforcement actions against companies that have harmed servicemembers and veterans. But companies that profit by cheating and exploiting our military and veterans are attacking the CFPB.

The CFPB’s Office of Servicemember Affairs has:

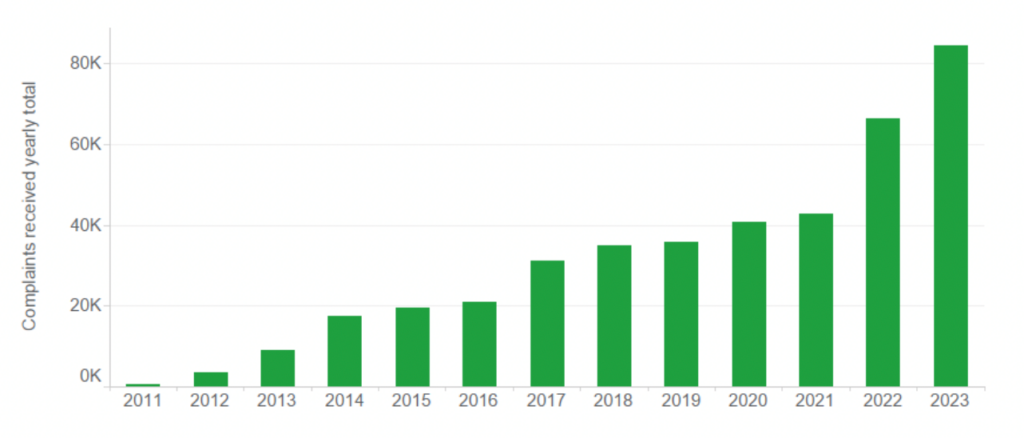

- Handled over 420,000 complaints from servicemembers, including problems with credit reports, debt collectors, banking services and credit cards.

- Refunded millions of dollars to people with overseas military addresses who would not have otherwise been compensated for their losses.

- Taken steps to rein in shady data brokers that purchase detailed personal information about servicemembers, veterans and their families for pennies per person.

- Highlighted that servicemembers pay more for auto loans than civilians, including that by the age of 24, around 20% of young servicemembers have at least $20,000 in auto debt

The CFPB has filed 42 enforcement actions standing up for the rights of our country’s veterans and servicemembers including:

- Permanently banning Navient from student lending and abusing veterans. Navient was the country’s largest student loan servicer, and the CFPB found that it falsely reported that severely disabled veterans were not eligible for loan forgiveness and continued to collect payments from them.

- Suing auto loan servicer SNAAC for abusing military servicemembers. SNAAC solicited military customers, then threatened to contact their commanding officers about their debt in order to coerce payments.

- Permanent bans against companies that repeatedly harmed veterans. The CFPB obtained lifelong bans against a “pension poacher” that was stealing veterans’ pensions, and against repeat offender RMK Financial from mortgage lending after years of lying to veterans.

- Pursued predatory lenders for violating the Military Lending Act. The CFPB has cracked down on car title lenders, pawn brokers, internet lenders and payday lenders for violating critical laws protecting servicemembers from abusive interest rates and terms.

The companies that the CFPB has held accountable for violating the law have attacked the CFPB since its inception. Wealthy venture capitalists who have been sued by the CFPB for violating the Military Lending Act are now trying to “delete” the CFPB to stop its work to eliminate junk fees and unfair practices.

The CFPB protects those who protect our country and fights for a fair financial marketplace. Protect the CFPB.

See all resources related to: Consumer Protection Regulation