A new form of fintech payday loan offered through cash advance apps uses “tips” as a form of disguised interest. These apps claim that tips are voluntary, but they use dark patterns, actual or implied repercussions for not tipping, manipulative interfaces, behavioral and psychological tricks, and other techniques to make tips almost as certain as required fees.

The New York Attorney General recently charged that one app, MoneyLion, “is relentless in charging fees and pressuring users for tips.” The California Department of Financial Protection and Innovation found that companies that push “tips” collect them 73% of the time.

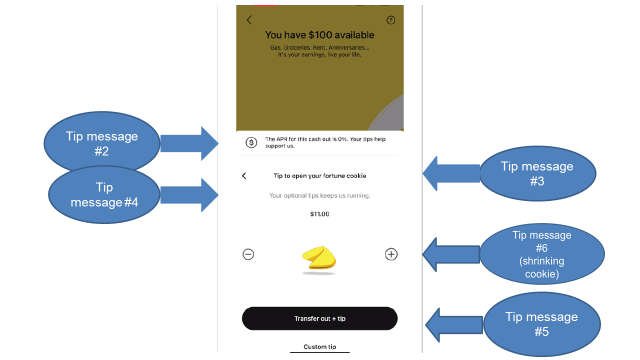

This video shows some of the techniques used by another app, EarnIn, to make it difficult to avoid tips. The borrower was subjected to 17 messages about the importance of tipping and needed to make 13 additional clicks to get an advance without a tip.

See all resources related to: Banking, Payments & Remittances